Whitman Property Tax Rate . Town of whitman board of assessors 54 south. property tax rates are expressed in dollars per thousand dollars of assessed property value. Failure to pay second half taxes will also. changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. the town of whitman, massachusetts. a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. Assessors set the levy rate based on the.

from www.todocanada.ca

Assessors set the levy rate based on the. property tax rates are expressed in dollars per thousand dollars of assessed property value. Failure to pay second half taxes will also. changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. Town of whitman board of assessors 54 south. a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. the town of whitman, massachusetts. whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in.

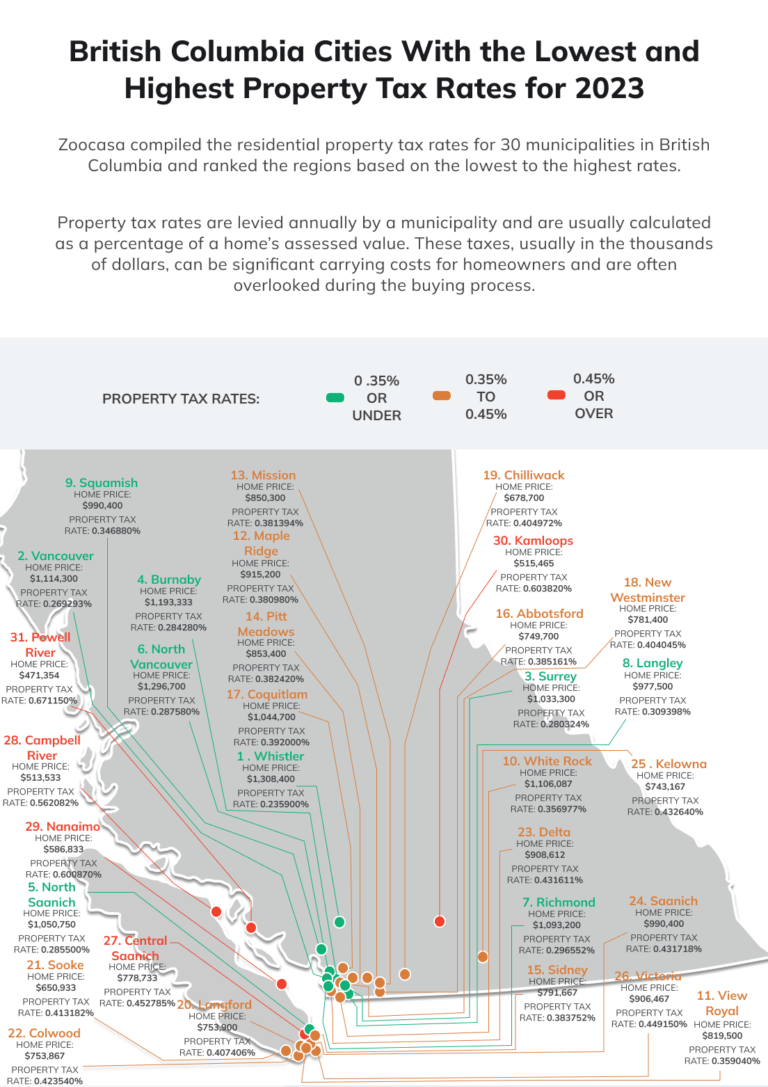

6038 in Kamloops and 2693 in Vancouver For a 1M House Property Tax Rates in British Columbia

Whitman Property Tax Rate a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. Town of whitman board of assessors 54 south. property tax rates are expressed in dollars per thousand dollars of assessed property value. the town of whitman, massachusetts. the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. Failure to pay second half taxes will also. Assessors set the levy rate based on the.

From masslandlords.net

How Much Are Your Massachusetts Property Taxes? Whitman Property Tax Rate changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; Failure to pay second half taxes will also. the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. property tax rates are expressed in dollars per thousand. Whitman Property Tax Rate.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Whitman Property Tax Rate whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. Town of whitman board of assessors 54 south. the town of whitman, massachusetts. Assessors set the levy rate based on the. property tax rates are expressed in dollars per thousand dollars of assessed property value. changes. Whitman Property Tax Rate.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Whitman Property Tax Rate the town of whitman, massachusetts. Town of whitman board of assessors 54 south. changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. Failure to pay second half taxes will also. . Whitman Property Tax Rate.

From whitmanpropertytax.site

Whitman County Property Tax Procedural Problems A website to disseminate the problems we see Whitman Property Tax Rate Town of whitman board of assessors 54 south. Assessors set the levy rate based on the. changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; Failure to pay second half taxes will also. whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and. Whitman Property Tax Rate.

From outliermedia.org

Detroiters’ 2023 property taxes are going up. Blame (mostly) inflation. Whitman Property Tax Rate the town of whitman, massachusetts. property tax rates are expressed in dollars per thousand dollars of assessed property value. whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. Failure to pay second half taxes will also. a 3% penalty will be added on june 1st,. Whitman Property Tax Rate.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Whitman Property Tax Rate Town of whitman board of assessors 54 south. whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. Failure to pay second half taxes will also. the town of whitman, massachusetts. Assessors set the levy rate based on the. the median property tax (also known as real. Whitman Property Tax Rate.

From www.linkedin.com

2022 property tax rates across 35 Ontario municipalities Whitman Property Tax Rate a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. the town of whitman, massachusetts. Failure to pay second half taxes will also. Town of whitman board of assessors 54 south. the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year,. Whitman Property Tax Rate.

From dor.wa.gov

Property tax history of values, rates, and inflation interactive data graphic Washington Whitman Property Tax Rate Town of whitman board of assessors 54 south. changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; the town of whitman, massachusetts. whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. the median property tax (also known as. Whitman Property Tax Rate.

From lobbyistsforcitizens.com

Residential Property Tax Rates…Northeast Ohio comparison Lobbyists for Citizens Whitman Property Tax Rate the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. property tax rates are expressed in dollars per thousand dollars of assessed property value. Town of whitman board of assessors 54 south. changes may be made periodically to the tax laws, administrative rules,. Whitman Property Tax Rate.

From www.chandleraz.gov

Property Tax Reports, Rates, and Comparisons City of Chandler Whitman Property Tax Rate property tax rates are expressed in dollars per thousand dollars of assessed property value. a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. Town of whitman board of assessors 54 south. whitman county’s ratio of assessments to market has been historically low, as low as 62% in. Whitman Property Tax Rate.

From www.armstrongeconomics.com

US Property Tax Comparison By State Armstrong Economics Whitman Property Tax Rate the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. Failure to pay second half taxes will also. the town of whitman, massachusetts. changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; a 3% penalty. Whitman Property Tax Rate.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Whitman Property Tax Rate a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; Town of whitman board of assessors 54 south. whitman county’s ratio of assessments to market has been historically low, as low as. Whitman Property Tax Rate.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Whitman Property Tax Rate the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. property tax rates are expressed in dollars per thousand dollars of assessed property value. a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st.. Whitman Property Tax Rate.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index American Incentive Advisors Whitman Property Tax Rate Town of whitman board of assessors 54 south. whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. a 3% penalty will be. Whitman Property Tax Rate.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Whitman Property Tax Rate the town of whitman, massachusetts. a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. property tax rates are expressed in dollars per thousand dollars of assessed. Whitman Property Tax Rate.

From www.azibo.com

Understanding the California Property Tax Rate Azibo Whitman Property Tax Rate Town of whitman board of assessors 54 south. whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. the median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. a 3% penalty will be. Whitman Property Tax Rate.

From www.landlordstax.co.uk

UK Tax Rates Landlords Tax Services Whitman Property Tax Rate Assessors set the levy rate based on the. property tax rates are expressed in dollars per thousand dollars of assessed property value. changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73%. Whitman Property Tax Rate.

From realwealth.com

How to Calculate Capital Gains Tax on Real Estate Investment Property Whitman Property Tax Rate whitman county’s ratio of assessments to market has been historically low, as low as 62% in 2022/2023 and 73% in. a 3% penalty will be added on june 1st, and an 8% penalty will be added on december 1st. Town of whitman board of assessors 54 south. changes may be made periodically to the tax laws, administrative. Whitman Property Tax Rate.